When it comes to the current financial scenario, investing has become easily accessible and diversified, particularly with options such as Mutual Funds and Systematic Investment Plans (SIPs). If you are an investment beginner or planning to expand your portfolio, you might wonder what is different one from others. Mutual Funds and SIPs are frequently mentioned in the same context, but they are two different things in the investment process. This in-depth blog post will discuss the main differences between SIP and Mutual Funds, their working, their pros and consand when to opt for one over the other depending on your investment needs and goals.

What is a Mutual Fund?

A Mutual Fund is a vehicle which channels your money along with money from many investors to invest in or develop one portfolio of assets such as stocks, bonds, or other securities. The most selling proposition of mutual funds is that they allow investors to gain exposure to a professionally managed portfolio without needing to select individual stocks or bonds.

Types of Mutual Funds

There are different types of mutual funds, each are distinct investment ideas and risk tolerances. These are equity funds, debt funds, hybrid funds, sectoral fundsand others.

Investment Management: Investment decisions are made by fund managers based on the objective of the funds. Fund managers are professionals who have the experience and expertise in the financial market, which becomes convenient for individual investors to gain from their judgment.

Diversification: Diversification is the major benefit of mutual funds. Mutual funds can invest in a variety of securities by obtaining money from numerous investors. The diversification of the funds protects against risk because the poor return of one investment is balanced by others performing better.

What is an SIP (Systematic Investment Plan)?

A Systematic Investment Plan (SIP) is not an investment product in itself but a technique for investing in mutual funds. Simply put, an SIP is a method of investing a fixed amount in mutual funds at regular intervals over a specific period of time.

- Regular Contributions: Investors decide on a fixed amount (e.g. 500/-, 1000/-) to be invested at regular intervals (monthly, quarterly) This strategy assists in developing a disciplined investment culture.

- Cost Averaging: Another advantage of SIP is rupee cost averaging. With a systematic investment plan, an investor purchases more units at low prices and fewer units at high prices. This method reduces the effect of market volatility and helps lower the average cost of unit purchase in the long run.

- Beginning Small: SIP enables investors to begin with small sums, which makes it simple for first-time investors to venture into investing. It’s a great choice for those with limited funds or those who prefer not to invest huge sums in the market upfront.

The Key Differences Between SIP and Mutual Fund

Now that we have established both definitions, let us analyze the distinction between SIP and mutual fund along different axes to enable you to make a well-informed decision.

| Feature | SIP | Mutual Fund |

|---|---|---|

| Definition | SIP is a method of investing in mutual funds by contributing a fixed amount at regular intervals. | A mutual fund is an investment vehicle that pools money from various investors to invest in diversified securities. |

| Investment Approach | Regular, small contributions over a long period. | Lump sum or SIP method for investing. |

| Investment Amount | Starts small, with as low as 500/- per month. | Lump sum investments, often higher amounts. |

| Risk Mitigation | Minimizes the impact of market volatility through rupee cost averaging. | Risk depends on the type of mutual fund chosen (e.g., equity funds are riskier than debt funds). |

| Investment Horizon | Ideal for long-term financial goals. | Suitable for both long and short-term goals. |

| Flexibility | Flexible—can increase, decrease, or stop investments anytime (except in tax-saving funds like ELSS). | Flexible in terms of lump sum or SIP. Redemption rules apply. |

| Suitability | Best for investors who prefer regular investments and those with a steady income stream. | Suitable for investors who can make a large, one-time investment. |

| Market Timing | SIP avoids market timing, investing regularly regardless of market conditions. | Lump sum investments may expose you to market risks, especially during high volatility. |

| Returns | Returns may vary depending on the mutual fund performance but often follow the market’s long-term trend. | Returns depend on the performance of the underlying assets in the mutual fund. |

| Liquidity | Generally, SIP investments in open-ended mutual funds are liquid, but some may have exit loads. | Mutual funds are liquid, but certain types (e.g. ELSS) may have lock-in periods. |

Read Small Business Ideas in Hindi

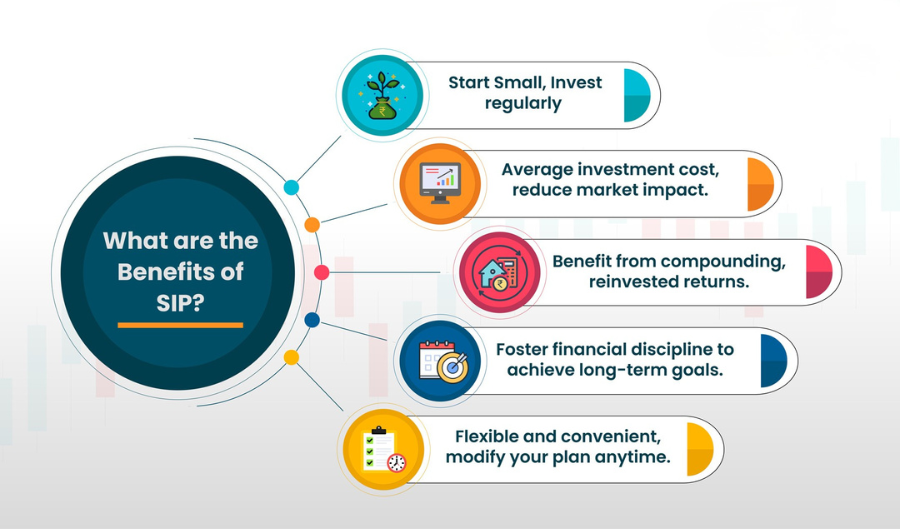

Advantages of SIPs

Rupee Cost Averaging: One of the biggest advantages of SIPs is that you can average your cost of investment over time. In a boom-unpredictabal market, where the unit price of a mutual fund keeps changing, you end up buying more units when the price is low and fewer when the price is high.

Discipline: SIPs promote disciplined investment. The periodic, fixed investment causes the investor to stick to his long-term financial plans without allowing him to time the market.

Affordability: SIPs permit you to invest as low as 500/-making them affordable for a large population of investors, including small investors.

Compounding Power: Long term, SIPs take advantage of the compounding power. The interest you earn on your investment will earn interest again, and thus grow your corpus phenomenally.

Flexibility: SIPs allow you flexibility in the contribution and the frequency. You can raise or lower the amount you invest or even suspend or cancel the SIP itself, making it convenient to make changes based on your financial health.

Lower Risk of Market Timing: As SIPs are regular investments, you do not have to worry about the “right” moment to invest in the market, which is usually a challenging task for the majority of investors.

Advantages of Mutual Funds

- Diversification: Mutual funds provide diversification, which serves to disperse risk through different asset classes. Diversification is one of the most effective ways of minimizing the risk of losing all your money as a result of poor performance from one security or asset class.

- Professional Management: The mutual funds are professionally managed by fund managers who possess the knowledge and experience to make intelligent investment decisions. This can be a great advantage for the investors who do not possess the time or knowledge to look after their own portfolios.

- Transparency: Mutual funds have to make disclosures of their holdings, performance and charges periodically. With this transparency, investors can see where their money is being invested and how the fund is doing.

- Tax Benefits: Some mutual funds, like Equity Linked Savings Schemes (ELSS), enjoy tax benefits under Section 80C of the Income Tax Act, allowing you to save tax while accumulating your wealth.

- Liquidity: Mutual funds provide high liquidity for most of them, you can redeem your units at any time (apart from certain funds with lock-in option like ELSS).

- Variety of Options: Through mutual funds, you can opt for a variety of investment approaches, such as equity, debt, hybridand sectoral funds, based on your risk acceptance level and financial objectives.

When Should You Opt for SIP instead of Lump Sum Mutual Fund Investments?

SIP is ideal for investors looking for consistent, long-term wealth creation. Here are some scenarios when SIP is the preferred choice:

- Regular Income: If you have a steady income and can make small, regular investments, SIPs allow you to create wealth without needing to make a large upfront payment.

- Long-Term Goals: SIPs are excellent for goals like retirement planning, children’s education, or building a substantial corpus over time.

- Beginner Investors: If you are a newcomer to investing and uncertain about market timing, SIPs save you from the stress of market timing.

- Rupee Cost Averaging: SIPs are particularly useful in fluctuating markets, as they average your investment cost.

When Should You Opt for Lump Sum Investments in Mutual Funds?

Lump sum investments are ideal if you possess a lot of money to invest in one go. Below are some situations where lump sum mutual fund investments are appropriate:

Surplus Funds: If you possess excess money that you do not require at the moment, you can invest in a mutual fund and gain from market opportunities.

Market Timing: In case you are confident that the market is ready to grow and you need to optimize the existing market scenario, lump sum investments provide the facility to take advantage of it.

Conclusion: SIP vs Mutual Fund – Which One Is Right for You?

The contrast between SIP and Mutual Fund are due to the investment method. SIP is a discipline method of investing in Mutual Funds, whereby you can invest constant amounts at regular intervals. While a Mutual Fund is an investment scheme where investors invest money collectively to create a diversified portfolio for them with the help of experts.

Both the options have advantages based on your financial objectives, investment horizon, risk tolerance and present financial status. If you like a disciplined gradual investment strategy, SIP is the best option. But if you possess a lump sum amount and wish to capitalize on existing market conditions, you can make a lump sum mutual fund investment.

Finally, the decision rests in your hand, based on your personal choice and financial objectives. You can even opt for both methods investing in SIPs periodically and in a lump sum when you have excess funds in hand.

Frequently Asked Questions

1. Is a mutual fund is same as SIP?

No, they are not the same. A mutual fund is a financial vehicle that Receives money from several investors to invest in a varied portfolio of investments. In Detail a Systematic Investment Plan (SIP) is an approach of investing in mutual funds by making regular investment through fixed amounts.

2. Is SIP safer than a mutual fund?

SIP is not safer by nature than a mutual fund. SIP is merely an investment method in mutual funds. The safety of either hinges on the selected mutual fund, because mutual funds can differ in risk based on their asset classification and investing approach.

3. Which is more suitable for long-term investment: SIP or Mutual Funds

SIPs are also usually thought to be an excellent option for building long-term wealth since they encourage disciplined investing, enjoy the benefit of compoundingand reduce rupee-cost averaging to lower market volatility. Mutual funds, based on whether investments are made through SIP or lump sum, too can prove to be a good long-term investment vehicle.

4. How do I know which SIP is better for me?

To select an appropriate SIP, consider your investment, risk tolerance and financial goals. If you are in doubt about making the choice, you can seek advice from a financial planner based on your personal situation.

5. For greater returns, mutual funds or SIP?

SIPs and mutual funds are also considered differently. SIPs are a way of investing in mutual funds for the long term, so both can be sources of profit. If you want higher returns, equity-oriented mutual funds, whether they are invested through SIPs or lump sum, might provide more long-term growth, although they involve greater risk.

6. Can I withdraw my SIP anytime?

Yes, you can always withdraw your SIP investments. But remember that there may be exit loads or charges based on the mutual fund scheme and its conditions. The process of redemption may also take a few days.

*Disclaimer: All information given in this article is generic in nature and for informational purposes only. It is not a substitute for personalized advice in your own situation. This is an information communication from Finance Hindi and not meant to be taken as an investment suggestion. Investments in securities market are market risks, read all the related documents carefully before investing.

Chirag Vaishnav is a finance enthusiast with deep knowledge of the stock market, investment strategies, and financial planning. He has spent years studying market trends, company fundamentals, and global economic movements. Coming from a background rooted in business and finance, Chirag is passionate about helping people make smarter investment decisions and achieve financial freedom. Through his insightful blogs, he simplifies complex financial concepts and shares practical tips for beginners and experienced investors alike. Many readers trust his analysis and guidance to navigate the ever-changing world of stocks and investments.